Failed streaming company Guvera is being investigated after burning through $180 million of investor’s money and before collapsing.

ABC’s 7:30 is reporting the Australian Securities and Investments Commission (ASIC) has started to ask questions about why 3000 investors are now out of pocket after Guvera took $180 million and ran a company that generated next to no revenue despite that enormous backing.

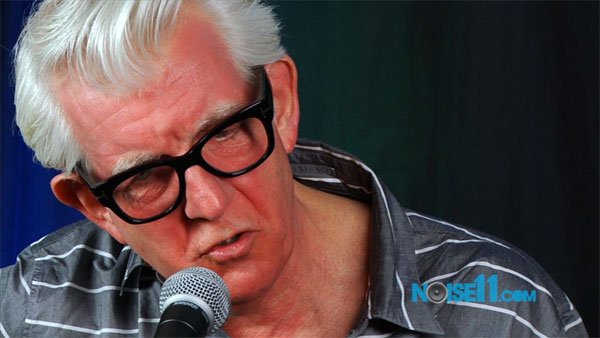

CEO Darren Herft and co-founder Claus Loberg will need to answer the tough questions from ASIC after the company was placed into administration in 2016.

Guvera promised to be a streaming company with a difference but the alternative to iTunes had problems from day one.

Initially the company model was based around free downloads paid by brand sponsorships. Companies would sponsor download artists, genres or demographics to reach their target audience and the fan should see the ad related to the brand as they downloaded the music.

In theory that made sense but in reality fans could download songs in the background and never see the brand associated with the sponsorship.

Guvera modified its model over time but as Spotify replaced iTunes and iTunes evolved into Apple Music, Guvera found it difficult to find its market.

That didn’t stop the hype. The company continued to sell its vision to mum and pop investors who gambled dearly on the company.