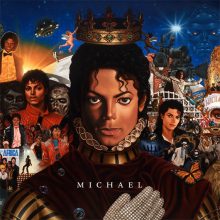

The IRS has served notice that the estate of Michael Jackson severely understated worth and income and is demanding $700 million in back taxes and penalties.

Documents have been filed with the U.S. Tax Court that alleges that the executor’s for Jackson said his net worth at the time of his death was $7 million while the IRS has assessed the worth at $1.125 billion. The massive difference was also deemed to be a gross misstatement which means the IRS can assess a penalty of 40% instead of the standard 20%.

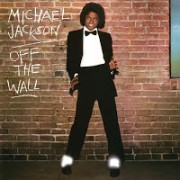

A good portion of the difference was attributed to the value of Jackson’s likeness which the estate valued at $2,105 and the IRS says was worth $434.264 million. In addition, the estate said that Jackson’s portion of the ownership of both his songs and those of the Beatles was worth nothing.

Yes, you read that right. They said the Beatles songs (and his) were worth $0.

The IRS said it was more like $469 million.

To be completely clear, the estate said that Jackson had borrowed against his portion of the catalog but at a valuation lower than the IRS’.

There are also numerous cases where the IRS said the valuations of other Jackson assets were understated, leading to the high amount owed.

It is assumed that the case will end up in court.

Read more at VVN Music

——————————————————————————————————————————————

Stay updated with your free Noise11.com daily music news email alert. Subscribe to Noise11 Music News here

Follow Noise11.com on Facebook and Twitter