It’s time to once again look back at the state of the music industry in the year just passed.

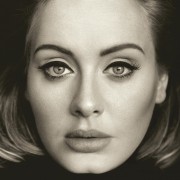

Remove the huge sales of Adele’s 25 and the pretty great sales of Taylor Swift’s 1989 and you might have a different story but those two album which, together, sold 9.4 million units worth of albums and 11.1 million units if you add in track equivalent albums (TEA) and stream equivalent albums (SEA), were major success stories that have not been seen in many years.

For our report, with numbers provided by Nielsen, we are going to concentrated on the actual sales figures and leave out TEA and SEA.

Album Sales

Overall, sales of albums have continued their long slide as consumers instead chose to cherry pick individual tracks for both downloading and streaming.

In 2015, album sales (CD, cassette, vinyl, download) totaled 241.4 million units, down 6.1% from 2014’s 257 million. When individual formats are broken out, CD’s continue to hold over half of the market, in marked contrast to the naysayers at major retailers who have cut their CD sections to a fraction of their former size. 2015 sold a total of 125.6 million physical CDs sold as compared to 103.3 million digital albums and 11.9 million vinyl albums; however, the day when the CD’s share will drop below the other formats is coming within the next year or two. CD sales 2014-to-2015 were down 10.8% while digital albums were only down 2.9%.

And then there is vinyl. It still only accounts for about 5% of the album marketplace, but unit sales were up 29.8% year-to-year, the format’s tenth straight year of growth. With more retailers, such as Barnes & Noble, starting to sell vinyl in their stores again, this trend should continue for the foreseeable future.

Where are you buying the albums? Well, still at mass merchants like Wal-Mart and Target, where 51.2 million albums were purchased in 2015, but that figure was down 18.6% from 2014. Chains accounted for 28.7 million (down 7.5%) while non-traditional retailers like Amazon and other internet merchants, concessions at live events and direct mail sold 40.9 million (up 6.2%). Finally, independent record stores were responsible for 17.3 million (down 5%).

Catalog albums also continue to just eek out a majority over current 122.8 to 118.5 million but that lead is growing as catalog was only down 2.9% compared to current which was down 9.2%.

Track Sales

Sales of individual tracks through download sites continues to dwarf album sales but the slide in year-to-year sales is starting to accelerate.

In 2014, 1.10 billion (not million, but billion) tracks were downloaded but, by 2015, streaming had begun to really cut into that number and the total for the year fell to 965 million, down 12.5%. Individual track sales was always the number the music industry could raise up the flagpole to show that things were not going south but, with this reversal, they are going to need to start trumpeting another format, and there is only one.

Streaming

Whether artists and record companies like it or not, streaming is the future of music consumption in the foreseeable future. Total streams almost doubled from 2014 to 2015, showing that acceptance of the new form of media is gaining wider acceptance.

Specifically, total songs streamed jumped from 164.5 billion in 2014 to 317.2 billion in 2015, an increase of 92.8%. While audio streams saw a really good jump, from 79.1 billion to 144.9 billion (83.1%), it is video streaming that is really growing. 2014’s 85.4 billion video streams grew to 172.4 billion in 2015, an increase of 101.9%.

Plus, for those that think streaming is a young person’s game, 75% of people in a recent survey said that they listened to music on-line in the last week and 44% said they did it on a smartphone.

Genres

The marketplace has once again proven that the report of the death of rock is still very, very premature.

Rock accounts for 24.5% of all music consumption with R&B/Hip-Hop at 18.2%. The real strength of the Rock genre, though, comes in the sales that it generates. Rock is responsible for 32.6% of all album sales with R&B/Hip Hop in second at 15.1% followed by Pop (14.1%) and Country (11.2%).

When individual tracks are examined, Pop jumps to the top with 22.6% followed by Rock (19.8%), R&B/Hip Hop (19.7%) and Country (11.5%).

For streaming, R&B/Hip Hop wins out with 21.1% followed by Rock (17.5%), Pop (14.5%) and Latin (8.5%).

Overall, the genres fall out as follows:

Rock (24.5%)

R&B/Hip-Hop (18.2%)

Pop (15.7%)

Country (8.5%)

Latin (4.5%)

Dance/Electronic (EDM) (3.4%)

Christian/Gospel (2.8%)

Holiday/Seasonal (1.7%)

Jazz (1.3%)

Classical (1.3%)

Children (1.1%)

The Big Sellers

As previously mentioned, Adele’s 25 is the big story of the year much like Taylor Swift’s 1989 was the same at the end of 2014.

The top ten albums of 2015 in sales (no TEA or SEA)

25 – Adele (7.441 million)

1989 – Taylor Swift (1.993 million)

Purpose – Justin Bieber (1.269 million)

X – Ed Sheeran (1.162 million)

If You’re Reading This, It’s Too Late – Drake (1.142 million)

In the Lonely Hour – Sam Smith (1.018 million)

Title – Meghan Trainor (1.007 million)

Beauty Behind the Madness – The Weeknd (862,000)

Fifty Shades of Grey – Soundtrack (861,000)

Kill the Lights – Luke Bryan (851,000)

For CDs alone, Adele is the only artist to have moved more than a million and she did it in style at 5.018 million in physical product.

Vinyl albums, which used to hold mainly veteran artists, only saw four make the top ten for the year (and that’s if you count one as a soundtrack of 70’s tracks).

25 – Adele (116,000)

1989 – Taylor Swift (74,000)

Dark Side of the Moon – Pink Floyd (50,000)

Abbey Road – Beatles (49,800)

Kind of Blue – Miles Davis (49,000)

AM – Arctic Monkeys (48,000)

Carrie & Lowell – Sufjan Stevens (44,900)

Sound & Color – Alabama Shakes (44,600)

Hozier – Hozier (43,000)

Guardians of the Galaxy – Soundtrack (43,000)

Spending on Music

Finally, artists are making there money these days by touring and, accordingly, that is where the consumer’s money is going and not to purchasing the music.

Admission to concerts accounted for 32% of spending by consumers in 2015 and, when another 10% for festivals and 10% for small club and DJ music sessions are added in, 52% of the consumer dollar is spent experiencing music live.

The following is the breakdown of how consumers spent their music dollars:

Admissions to live music concerts (32%)

Purchase of physical forms of music (13%)

Purchase of digital tracks/albums (11%)

Satellite radio subscriptions (11%)

Admissions to music festivals (10%)

Paid on-line streaming services (7%)

Music gift cards (7%)

Admission to small live music sessions (5%)

Admission to DJ events (5%)

——————————————————————————————————————————————

Never miss a story! Get your free Noise11.com daily music news email alert. Subscribe to the Noise11 Music Newsletter here

Listen to the Noise11 Music News channel now at iHeartRadio

Follow Noise11.com on Facebook and Twitter

NOISE11 UPDATES are now in Apple News

more from vvnmusic.com